Un univers de solutions

à vos enjeux

donnez vie à vos

ambitions

la franchise avance

Développement de réseaux de franchise : accélérez votre croissance avec Progressium

Développer

votre réseau de franchise

Quelle que soit l’étape de la vie de votre réseau, vous nourrissez des ambitions : le faire grandir, le rendre plus performant, accroître la rentabilité des points de vente et la vôtre, gérer les caps de croissance et les moments-clés… Graines de réseaux, jeunes pousses, étoiles montantes, ou réseaux référents : toutes vos ambitions ont une solution !

Trouver

votre franchise

Que vous souhaitiez vous lancer en créant votre franchise, ou que vous soyez déjà multi ou pluri franchisé, PROGRESSIUM vous oriente vers les réseaux qui vous correspondent parmi les dizaines d’enseignes que nous accompagnons, dans les secteurs food, service, et retail. Parce que chaque projet est unique, et que vos attentes en termes de rentabilité, d’accompagnement, et de valeurs vous sont propres.

nombre de réseaux accompagnés

nombre d’ouvertures

multi et pluri franchisés en contact

PROGRESSIUM : la franchise avance

Depuis 2011, nous agissons aux côtés d’une grande diversité de clients, de toutes tailles et de tous types de réseaux de commerce associé : franchise, commission-affiliation, concession, licence de marque.

Nous avons à coeur de transmettre nos expériences terrain et la complémentarité de nos expertises au service de votre succès.

À la croisée des ambitions des réseaux et des entrepreneurs, nous partageons avec vous toutes les forces de la franchise.

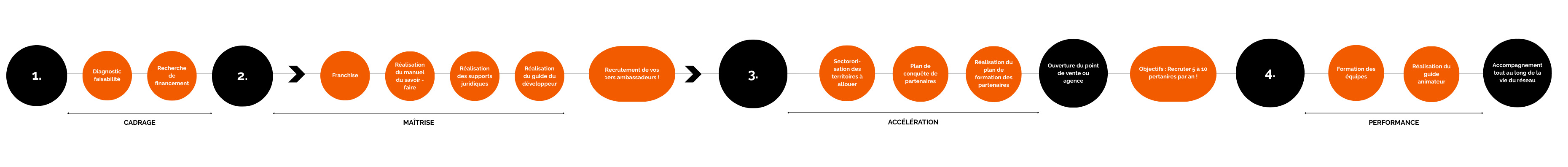

Etapes de vie d’un réseau avec la méthode MAP©

MAP, comme Maîtrise, Accélération, Performance !

Cette méthodologie s’appuie sur les expériences et convictions de nos experts de 9 métiers complémentaires, aux côtés de centaines de réseaux accompagnés. Car le parcours de franchiseur est jalonné de caps successifs, et de décisions-clés à prendre pour permettre l’essor de votre réseau, en toute sérénité.

International

Vous souhaitez développer votre enseigne à l’international ? Nous aidons les réseaux porteurs de cette ambition à franchir cette étape-clé, en apportant une démarche structurée, selon une méthodologie éprouvée.

Parce que devenir une marque reconnue à l’international nécessite de planifier puis orchestrer la feuille de route qui transforme votre ambition en succès !

Les demandes des enseignes étrangères pour venir en France sont de plus en plus nombreuses que ce soit au niveau du marché ou pour PROGRESSIUM, cela est lié, entre autres, au fait que notre pays est le leader européen de la franchise, nous avons donc créé tout naturellement ce pôle international.